Small Business Taxes / Photography

January 20, 2023

I’ve been doing my own taxes since I was 16 when we were allowed to send in paper form and my grandmother made me sit down at the table and do them by hand. (I’ve been self-employed for 19 years.) Thankfully we don’t need to do that anymore and there are programs to do it for us. I personally use Turbo Tax – it’s what I know. I’m not saying it’s better than any other program. If you are a small business and want to use it, you will need to pay for the small business version.

Turbo tax will walk you through everything, so that’s awesome. The problem is you need to get all your shit together first! That’s the hard part. I am not a tax professional – this is just how I do my taxes.

This link should give you 20% off – Turbo Tax if you are new to turbo tax that is.

What can I deduct?

- Equipment

- Camera, lens, computer, flashes, strobes, hard drives, Ipad, Watch etc.

- High-priced items will be considered an asset and you can spread it through the years or all at once.

- Classes/workshops/training

- Office Equipment

- Desk, Chairs, TV (if you do IPS), paper, pens, walking treadmill, etc.

- Travel

- You can either deduct your miles OR your car payment/maintenance/gas – You can not deduct both. Once you go to miles, I do not believe you can change. Don’t quote me.

- I personally do miles, it’s easier that way for me.

- Any hotel room/Airbnb you stay at due to work – wedding, workshop, traveling out of the area for a session. Purchased the room for a photoshoot.

- Miles – You write off the miles you travel for your business. If you go to/from the bank for your business, a restaurant, photoshoot, wedding, workshop, business meeting etc.

- Food

- You can deduct any time you meet with clients in a food setting – it can’t be over the top!

- If you are traveling out of the area and require a nights stay, all the food is also deductible

- Digital Items

- Cloud, Backblaze, your website domain, hosting, website, Subscriptions like Adobe, presets,

- Supplies

- Props, Camera bags, basically anything to do with your business.

- Labs

- Building Supplies

- If you built a greenhouse, put new flooring in your studio, built a prop etc.

- Shipping

- Business Insurance

- Equipment Rentals

- Credit Card Processing Fees

- Paid Advertising

- Contracts / Lawyer Fees

- Any Refunds made or giveaways

- Any Interest on your credit cards or business loans

- Any payments to a 2nd shooter, assistant, social media manager etc.

- Health Insurance – If you pay your own insurance

- Cell Phone & Internet

- If you have a cellphone family plan, you do not write your whole bill off, you write your phone only.

- New Cellphone

- Any Internet equipment you needed

- Home Office

- If you have a home office or studio that is used exclusively & regularly for your business you have the option to do a $5 per sqft deduction (the maximum size for this option is 300 square feet. ) or a standard deduction. Which is based on the %. Turbo tax will do this for you, just know the square footage of your office/studio and your whole house.

- Mortgage interest & Property Taxes or rent

- Utilities. (electric / gas / water)

- Insurance

- Security System – like adt

- *If you use a home office deduction please note when you sell your home, you will have to claim a part of the depreciation back on your taxes. I ran into this in 2020, so just be aware. Overall you are better off claiming a home office deduction if you need to.

- If you have a home office or studio that is used exclusively & regularly for your business you have the option to do a $5 per sqft deduction (the maximum size for this option is 300 square feet. ) or a standard deduction. Which is based on the %. Turbo tax will do this for you, just know the square footage of your office/studio and your whole house.

- SELF EMPLOYMENT TAX

- You can claim 50% of what you pay in self-employment tax as an income tax deduction. You will put this on “other taxes”

- To figure this out… Take your NET (after all your deductions) So let’s say you make $50k and your deductions were 25k, so your net income is $25k.

- 25k x 92.35% = 23,087.50 (why? The amount subject to self-employment tax is 92.35% of your net earnings from self-employment.) (also don’t ask it’s the IRS..)

- 23,087.50 x 15.3% = $3532.39. – This is your self-employment tax. So then you take that number and divide it by 2.

- 1766.19 on “other taxes” as a deduction for your self-employment tax

How I prepare my taxes.

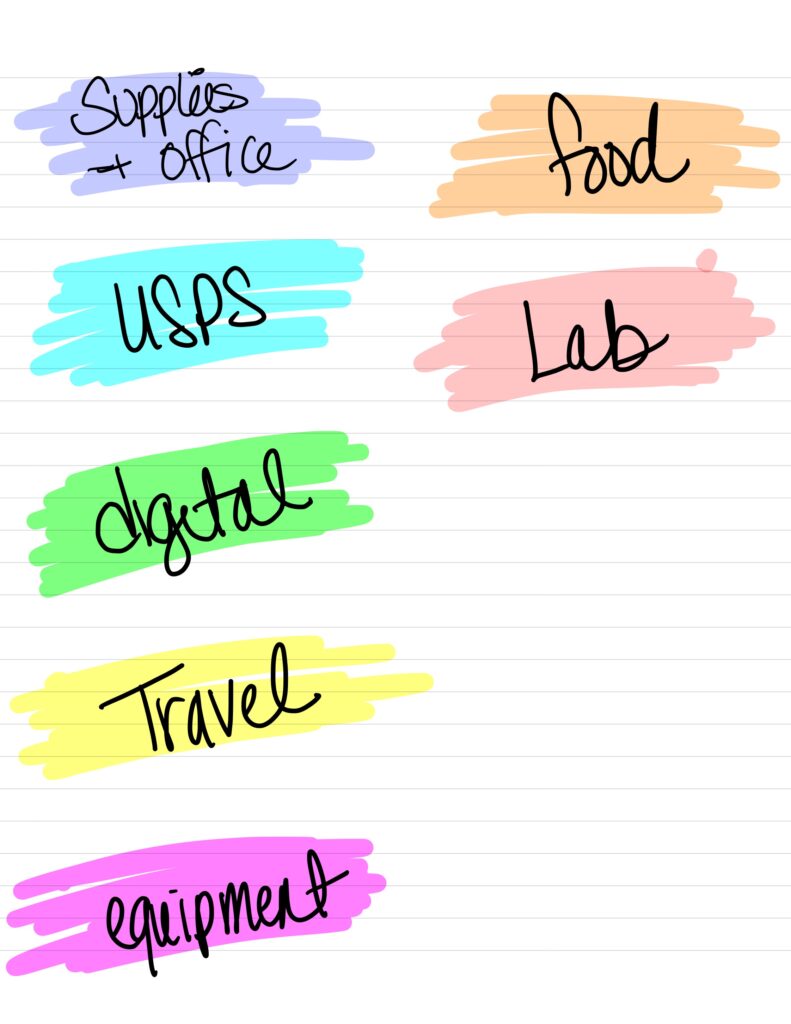

I use an app called GoodNotes on my Ipad. I’m not into QuickBooks and all those other amazing things that can keep track of everything for you. I am so old school. I color-code my expenses. Even though every year I go in thinking I will remember to write down every item I purchased for my business, I don’t. So at the end of the year, I am going through my amazon account, Venmo, paypal, my business credit card, and sometimes even my personal one. It’s easier than going through all the receipts I have in a box.

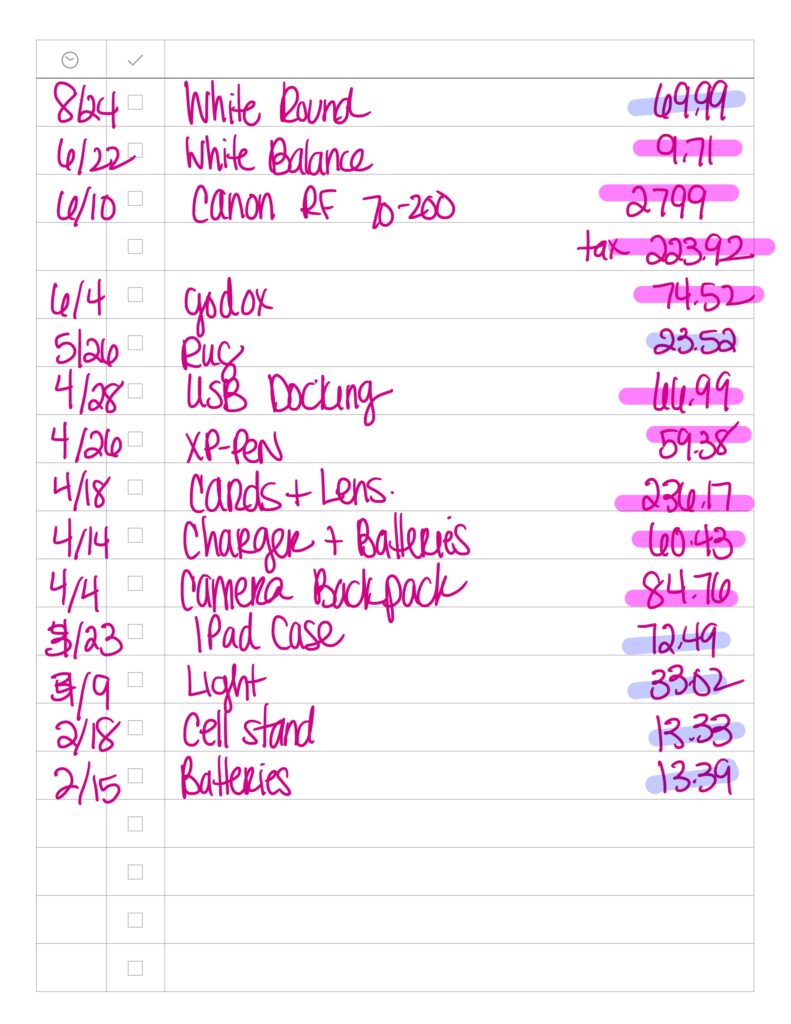

Here is an actual page from my tax preparation. These items are from Amazon. I even color code where it’s from, for example, amazon is pink while my business credit card is blue. (The lens will be put under an asset and not sure if I will take the full or depreciate it. Depends on how everything looks.) It is time-consuming, so if you can do it through the year – please do!

The reason I color code is because you do not have to list every single thing. It’s easier to go through and scan your pages for “pink” and add-up groupings. You do not have to put you flew to South Carolina, Florida, and Arizona, you can put flights $849, and hotels $799.

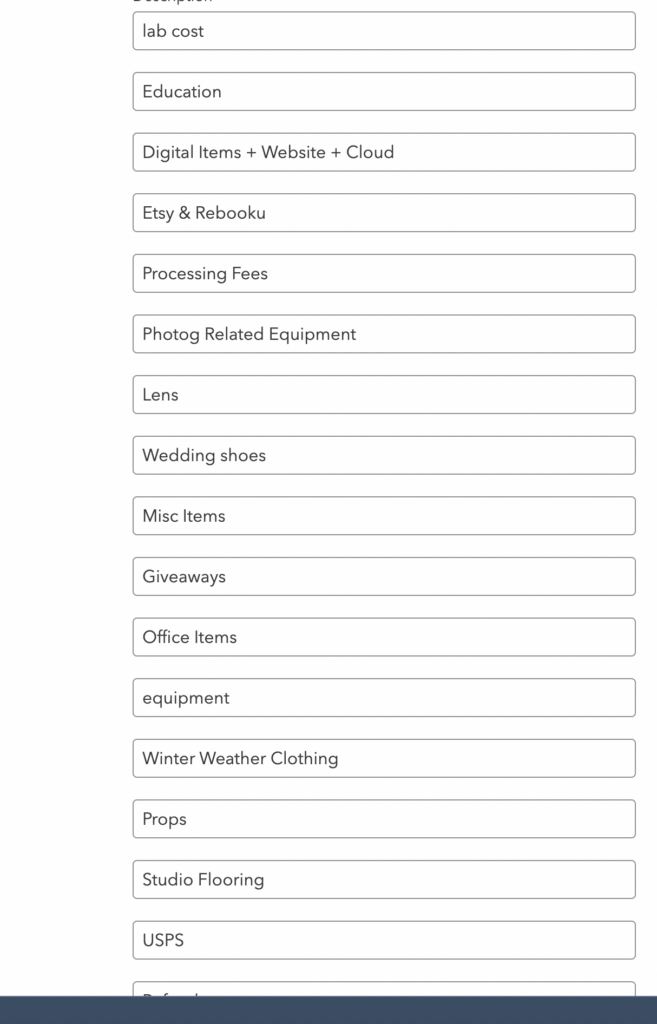

Below is my actual turbo tax List under miscellaneous expenses. (lens here is for the cheaper ones I purchased as well)

We built a greenhouse in my backyard, I’m totaling the entire bill and entering it as a greenhouse under assets.

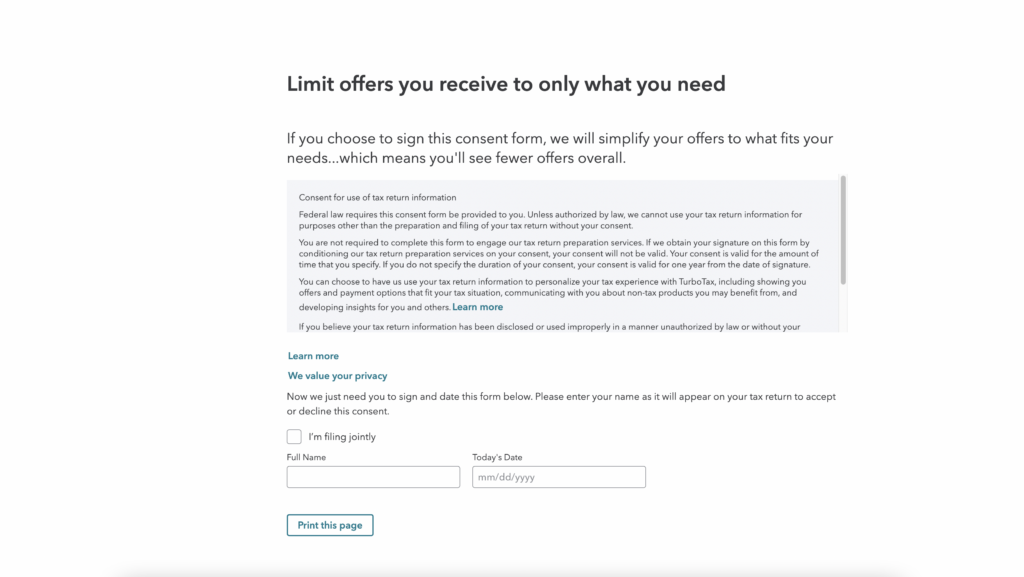

On turbo tax.. decline this stuff.. do not do the max (unless you want to), just do the first one (cheapest) and each time it will try to get you to upgrade, make sure you are paying attention and do not click to upgrade.

I hope this helps a little. I promise it’s not as scary as it sounds. However, your tax owed might be. Turbo tax does a really good job of walking you through everything. It’s just really being prepared with it all before you start your taxes.